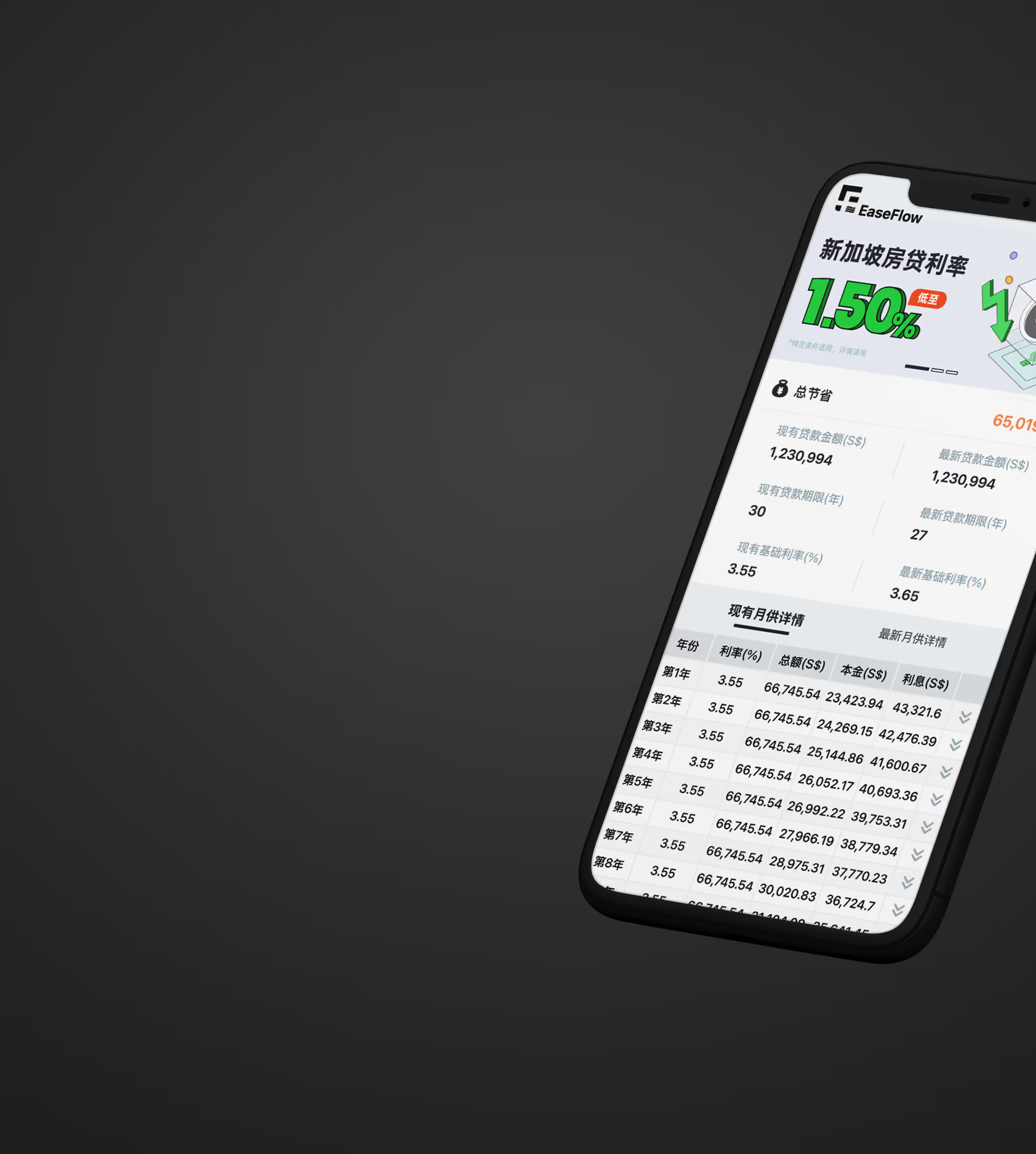

Refinance Calculator

Thank you for your submission!

Get Full Report & Savings Plan

FAQ

Frequently Asked Questions

What is Mortgage Refinance?

Refinancing replaces your existing loan with a new mortgage to get lower rates, more flexible payments, or shorter terms. Many Singapore homeowners refinance after the lock-in period to cut monthly costs and save tens of thousands in interest.

Whether you own an HDB or private condo, our mortgage advisors can help you find the most cost-effective refinance plan. Optimize your finances and make your mortgage work smarter.

Example

Current Loan

3.5%

Interest Rate

S$800k

Remaining

New Loan

2.8%

Interest Rate

S$800k

Remaining

Why Refinance?

Reduce total interest payments

For example, switching from a floating rate to a fixed rate locks in stable future repayments, or changing banks can provide better packages and services.

Consolidate multiple loans for better rates

If market interest rates drop, refinancing your home loan can secure a more favorable rate, potentially saving thousands to tens of thousands in interest over the long term.

Better loan structure

If you have multiple loans (e.g., a home loan plus a home equity loan), they can be consolidated into a single refinancing loan with unified repayments and a better interest structure.

Flexible repayments

Some banks offer flexible partial repayment or redraw options, helping clients manage their funds more efficiently.

Reduce monthly burden

Reducing interest rates or extending the loan tenure can lower monthly repayment pressure and improve cash flow, particularly for clients looking to free up cash for other purposes.

Property Cash-Out

You can also extract cash from the increased property value for renovations, investments, education, or other needs without selling the property. This is also known as a Home Equity Loan or Equity Term Loan.

What is Property Cash-Out?

Equity Term Loan allows borrowing against property appreciation or paid-off portion during refinance. Funds can be used for:

Example

Property valued at S$1,500,000 with S$800,000 outstanding may allow S$325,000 cash-out (subject to LTV).

Refinance Process

4 months before current loan ends

Assessment

Analyze existing loan

Determine potential interest savings

Compare Packages

Review latest bank rates

Choose best plan

Prepare Documents

We assist with full process

Submit Application

Documents submitted

Approval in 1–2 weeks

Review contract details

Sign & Disburse

Lawyer appointment

Sign documents with lawyers to complete bank transfer

Ongoing Support

Refinance reminders

Monitor rates

Optimize loan structure

Avoid penalties

Refinance Costs

Many banks offer legal fee subsidies, lowering actual costs. We help find the best deals.

Example

Lawyer Fee

S$2,000 – S$3,000

Loan & property transfer documents

Valuation Fee

S$300 – S$500

Property appraisal

Early Repayment Penalty

0% - 1.5%

During lock-in

New Bank Fee

Usually free

Bank subsidized

Fire Insurance Transfer

S$150 – S$200

Update beneficiaries

Need Help?

Free 1-on-1 Analysis

Discover Your Potential Savings

Mortgage, Fully under Control

※ Loan calculations are for reference only. Actual approval, rates, fees, and terms depend on the bank.※ EaseFlow complies with MAS regulations. Our service is free; bank commission does not affect your rate.※ We comply with PDPA. All personal data is encrypted and never shared without consent.※ Market analysis and rate trends do not constitute financial advice.※ Testimonials reflect real past experiences but do not guarantee future outcomes.※ For full terms, visit easeflowsg.com/terms-of-service.