A Smoother Home Loan

Starts with EaseFlow

Bank-Accredited Partners

Our Services

Secure Your Mortgage

Faster Easier Cheaper

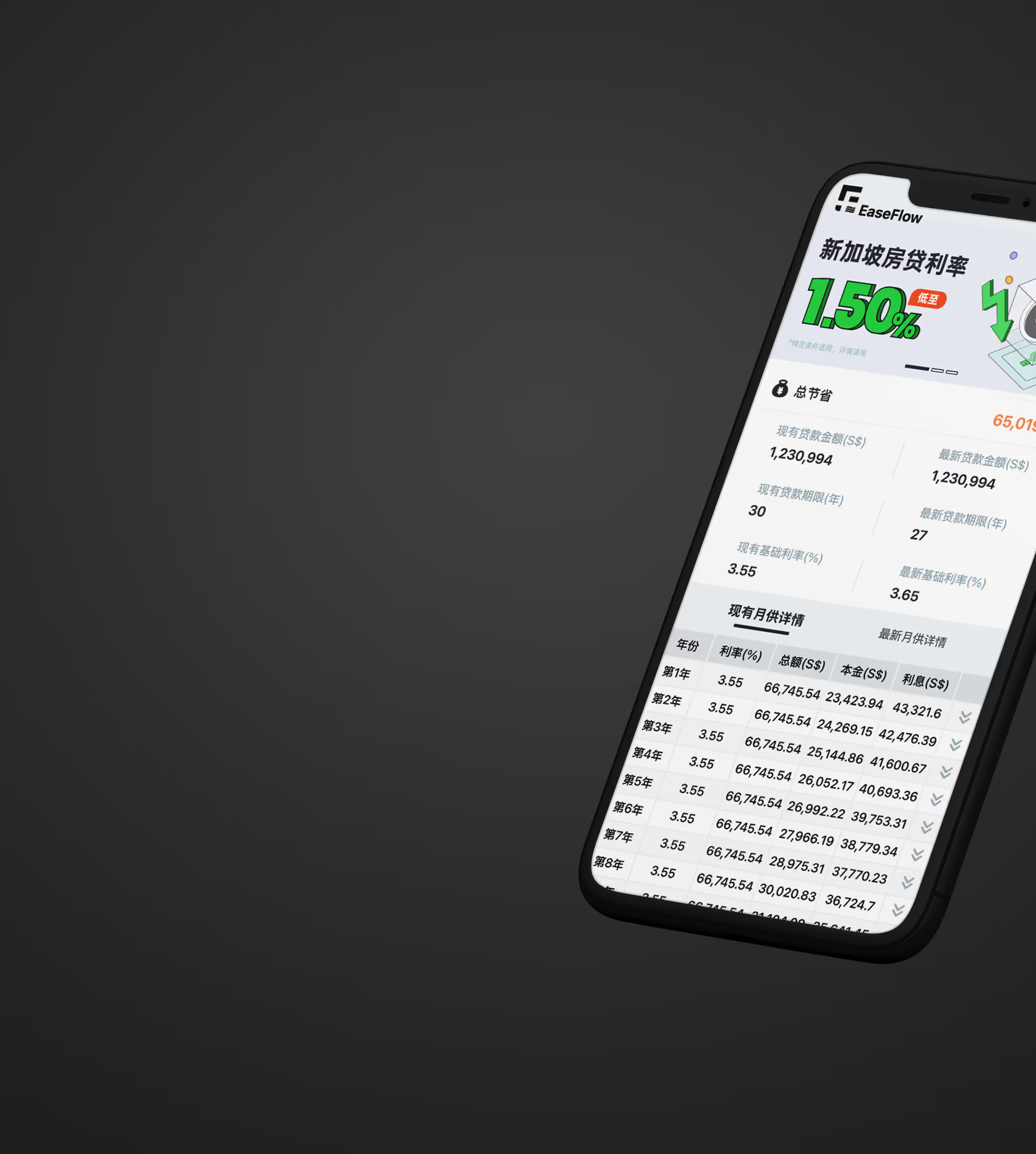

How much can you borrow? Monthly payments

Accurate numbers. No extra interest.

Which bank offers the best deal?

Download Our WeChat Mini-Program

Technology + Expertise = Faster, Cheaper, Smarter

Trusted Singapore Home Loan Advisor

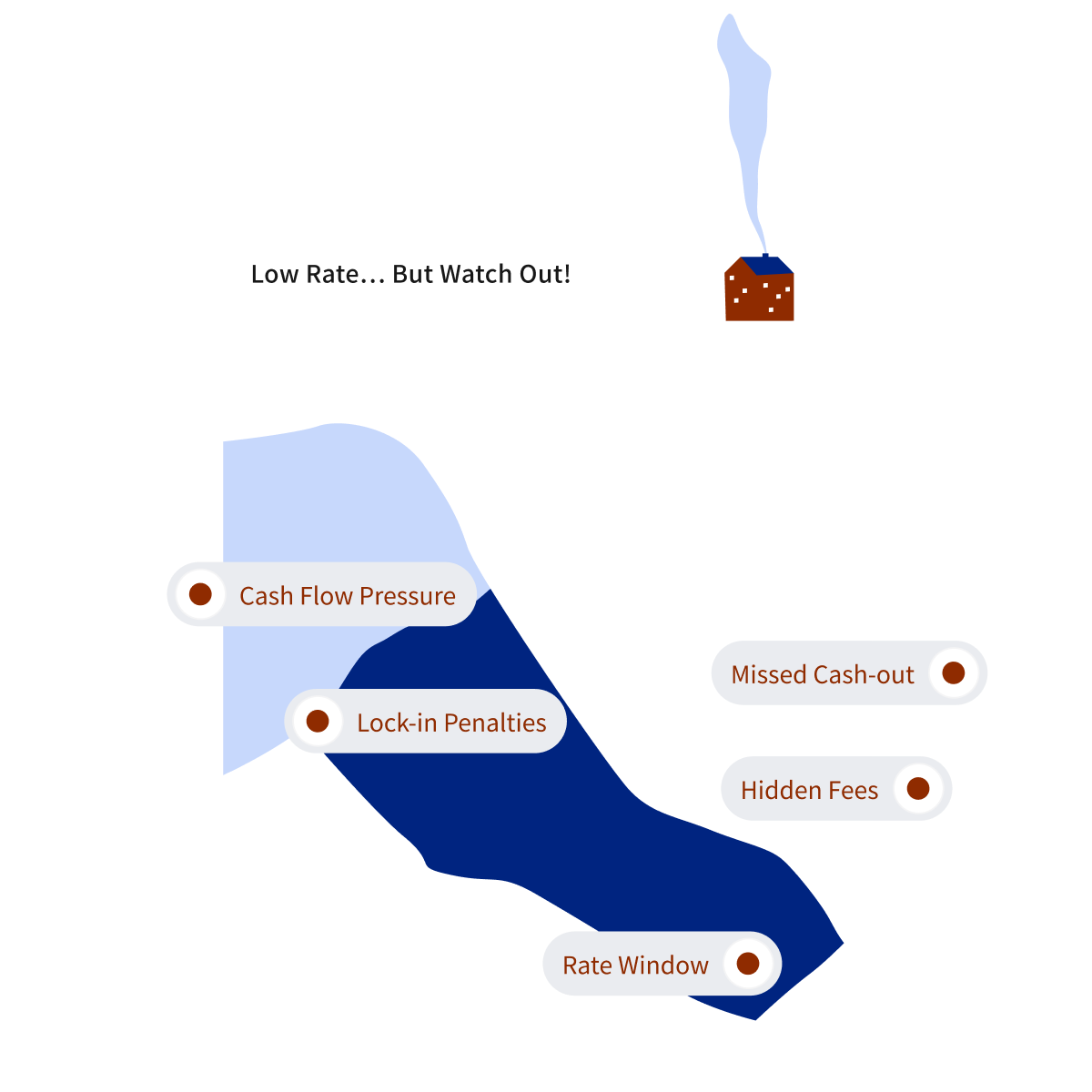

Not Just Rates

Strategy Matters

Lowest rate ≠ Lowest cost

We Help You Uncover Hidden Costs

Interest rates are only the starting point — the real cost lies in the fees and structure. We help you see the full picture so you can choose a truly low-cost loan strategy.

Expert guidance from those who know Singapore mortgages inside out

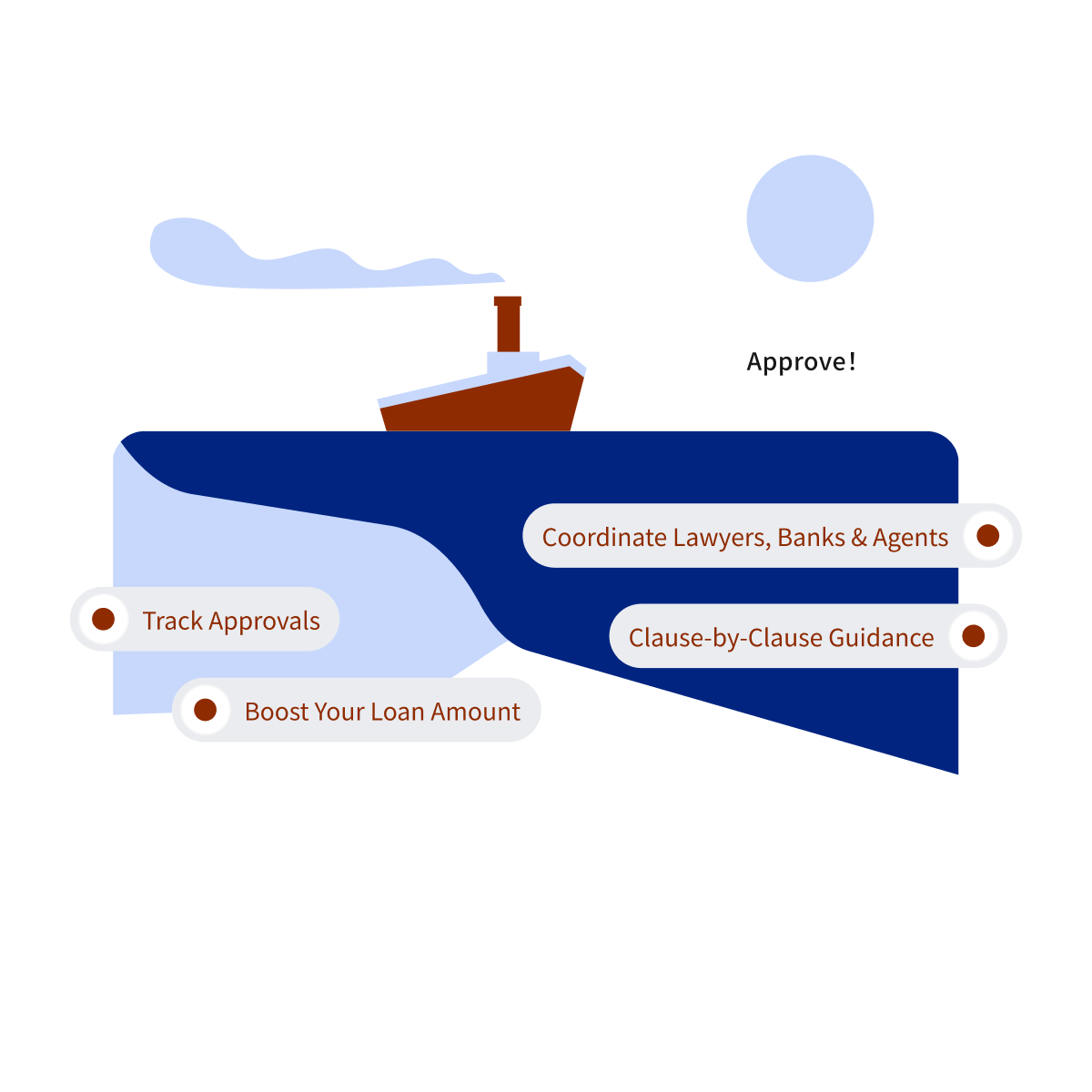

Plan the Shortest Route to Loan Approval

From guesswork to precision. From application to full repayment, we're on your side.

Protect Your Cash Flow from Start to Finish

Balance Risk, Never Miss a Savings Opportunity

We're not just brokers; we manage your financial flow with precision.

Professional, Zero Cost

Free, But Never Cheap

As an officially accredited partner of major banks, our service is 100% free for clients. You may wonder: Does free mean worse rates? The answer: Absolutely not.We work directly through formal bank channels.

You receive the exact same rate as going to the bank yourself.

0-Cost Professional Service

Bank-Accredited Partner

100% Transparent Rates

Our Services

A Smarter Way to Borrow

All Banks, One Advisor, Zero Cost

Rate Negotiation

We negotiate with banks on your behalf with bulk-rate bargaining power.

Faster Approval

We understand each bank's underwriting logic and help you plan ahead to speed up approvals.

Cross-Border Assets

We understand asset structures in China, the U.S., and globally, enabling smoother overseas asset verification.

Full Process Management

Client Testimonials

Hear What Our Clients Say

FAQ

Frequently Asked Questions

No. The rates provided by brokers are exactly the same as the official bank rates, and sometimes brokers can even access internal bank promotions — which can save you more.

You don't pay any fees. The commission comes from the bank, and we only earn it if we successfully match you with the right loan solution.

Rates fluctuate constantly and depend on your profile. We monitor daily to recommend the best solution. We monitor all banks' rates daily and recommend the most cost-effective solution tailored to you.

Each bank has different approval preferences:

- Some favor overseas income

- Some focus on cash flow

- Some are more friendly to self-employed applicants

We assess your overall profile first and match you directly with the banks most likely to approve your loan — increasing your success rate and shortening the process.

Yes. Many banks accept the following income or asset types:

- Overseas income (with supporting documents)

- Overseas or local asset proof

- Business or dividend income

- Family office or high-net-worth verification

We design the most feasible loan solution based on your financial structure.

Absolutely. We:

- Strictly comply with Singapore's Personal Data Protection Act (PDPA)

- Store all data securely with controlled access

- Follow all banking and regulatory requirements

- Undergo regular internal compliance audits

Your information is used only for the mortgage application process and will never be shared with unauthorized parties.

Need Help?

Comparing all banks fairly and explaining the true cost

Your Home Loan, Smoother with EaseFlow

※ Loan calculations are for reference only. Actual approval, rates, fees, and terms depend on the bank.※ EaseFlow complies with MAS regulations. Our service is free; bank commission does not affect your rate.※ We comply with PDPA. All personal data is encrypted and never shared without consent.※ Market analysis and rate trends do not constitute financial advice.※ Testimonials reflect real past experiences but do not guarantee future outcomes.※ For full terms, visit easeflowsg.com/terms-of-service.