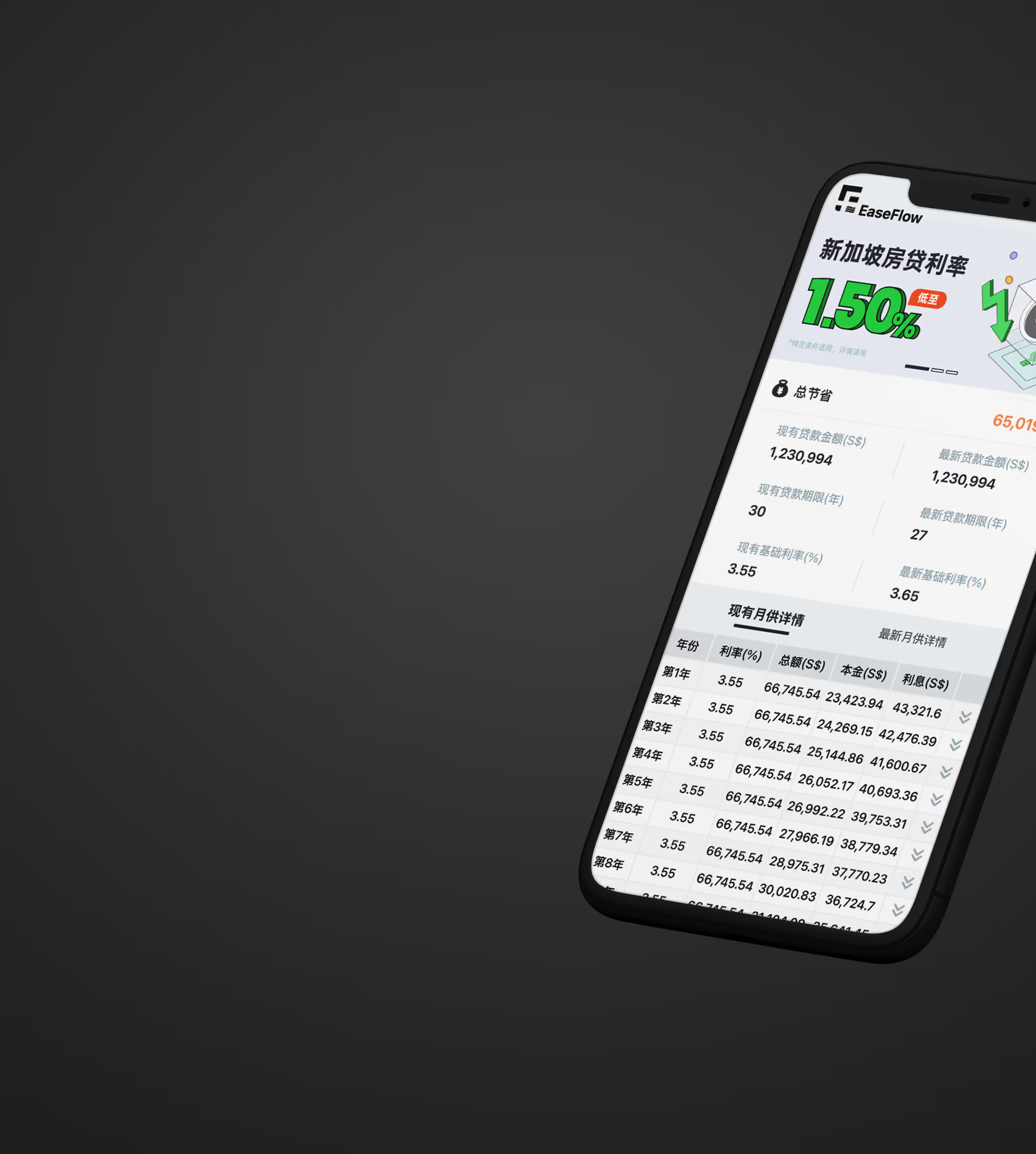

Mortgage Calculator

Thank you for your submission!

Thank you for your submission!

Payment Plan

Payment Plan

Thank you for your submission!

Repayment Plan

Repayment Plan

Thank you for your submission!

Get Full Report & Better Saving Options

FAQ

Frequently Asked Questions

When should I apply for a loan?

Tailored Saving Plan

Assess income and debts

Confirm and maximize loan eligibility (IPA)

Compare banks and packages

Prepare for rate negotiation

Submit Loan Application

After paying the option fee and receiving the sale agreement, submit your application before the exercise fee

Instant submission

Real-time status updates

Detailed explanation of contract terms

Confirm interest rate

Confirm loan approval conditions

Sign Contract & Disbursement

Coordinate with lawyer

Sign documents and complete bank transfers

Ongoing Support

Refinancing reminders

Rate window monitoring

Optimize loan structure

Avoid penalties

What is LTV (Loan-to-Value)?

LTV represents the percentage of the property value that a bank is willing to lend. MAS sets different LTV limits for various property types and buyers.

HDB Flat

Max 25 years

Private Property

Max 30 years

2nd Home

Max 30 years

3rd+ Home

Max 30 years

Stamp Duty

Basic Stamp Duty

Property up to S$1,000,000

Property up to S$1,500,000

Property up to S$3,000,000

Property over S$3,000,000

Additional Buyer's Stamp Duty (ABSD)

Citizens

PRs

Foreigners

Companies

Choosing the Right Interest Rate

Off-Plan Private Property

Completed Private Property

HDB Flat

Fixed Rate

Fixed rate during lock-in, ideal for stable installments

Stable monthly payments

Easy budgeting

Protects against rising interest rates

Singapore Overnight Rate / Floating Rate

Based on Singapore Overnight Rate, fluctuates with market, usually below fixed rates

Currently lower than fixed rates

Tracks market trends

Flexibility

MSR & TDSR (Debt Ratios)

Mortgage Servicing Ratio

Who It's For

For HDB & EC applicants only

How It's Calculated

ExampleIf your monthly salary is S$6,000, your mortgage installment cannot exceed S$1,800.

Total Debt Servicing Ratio

Who It's For

For all residential and commercial loans

How It's Calculated

Include

Maximum Limit

Max 55% of monthly income

ExampleIf your monthly salary is S$10,000, total debt installments cannot exceed S$5,500.

Need Help?

See how much you can save with a 0.5% lower rate

Your Home Loan, Smoother with EaseFlow

※ Loan calculations are for reference only. Actual approval, rates, fees, and terms depend on the bank.※ EaseFlow complies with MAS regulations. Our service is free; bank commission does not affect your rate.※ We comply with PDPA. All personal data is encrypted and never shared without consent.※ Market analysis and rate trends do not constitute financial advice.※ Testimonials reflect real past experiences but do not guarantee future outcomes.※ For full terms, visit easeflowsg.com/terms-of-service.